What is a tenant credit check?

To prevent future disputes, many landlords require their potential tenants to take a credit check before signing a lease. This inquiry validates the tenant’s financial capabilities and determines if they can pay for their rent each month. This way, landlords limit the risk of having to chase their tenants for payments once they have signed the lease!

“In order to establish a future lessee’s payment habits, a lessor may enlist the services of a personal information agent (commonly called a “credit bureau”).” Tribunal administratif du logement

Everyone who makes monthly payments (pre-authorized or not) has a credit report. Points are accumulated based on the applicant’s good or bad habits. They are reported as a “credit score”. If the applicant has any unpaid or late payment notes, the landlord conducting the investigation will be notified.

Although it is a common practice before taking possession of a dwelling, the credit check must comply with the law to respect the tenant’s right to privacy and protection of personal information.

What is the difference between a credit check and a pre-rental survey?

A credit check generally includes validation of the prospective tenant’s identity and an analysis of their credit and payment history.

A pre-rental survey is a more detailed check that includes a credit investigation. It analyses other history, behaviors, and habits of the potential tenant. Both terms are commonly used to refer to these types of inquiries, so it is crucial to determine what you want to check.

Here is some information that can be requested and verified during a pre-rental survey:

- Name, first name, current address, date of birth

- Credit report

- Criminal record

- Contact information or letter of recommendation from employer (letter of recommendation)

- Contact information or letter of recommendation from previous landlord

How to make a credit check?

“To do so, the lessor must get the future lessee’s consent. Once consent is given, the check may be done using a minimum of personal information. Generally, personal information agents can very efficiently find a personal file in their data banks using only the full name, address and date of birth.” Tribunal administratif du logement

The request can be made to companies specializing in credit investigations for dwellings. Please note that a credit check or a pre-rental survey cannot be conducted without the written consent of the tenant! The tenant can refuse or accept the request for a credit check. It is, therefore, preferable to send a form requesting the agreement and the necessary information.

The result of the investigation is usually received within 48 hours. If the owner refuses or if the results of the survey are not satisfactory, the owner may withdraw the application. Generally, there is a fee of approximately $12 for a simple survey. Just as it is recommended that a home or car inspection be conducted before purchasing a home or car, it is advisable to take the time to evaluate the record of future tenants.

What are the best practices for a pre-rental survey?

- Always conduct a complete pre-rental survey before renting a unit or, at the very least, a credit check (better safe than sorry!)

- The cost of the investigation is usually assumed by the landlord

- Tenants (like any other individual) can check their file at any time with the evaluation agency and demand corrections if necessary. It is a good thing to do! Many would be surprised at the number of mistakes on their credit report.

- It is possible to do a free online check in the archives of the SOQUIJ (Société québécoise d’information juridique) to see if there is a judgment against the potential tenant. Just go to the SOQUIJ website and enter the name of the applicant.

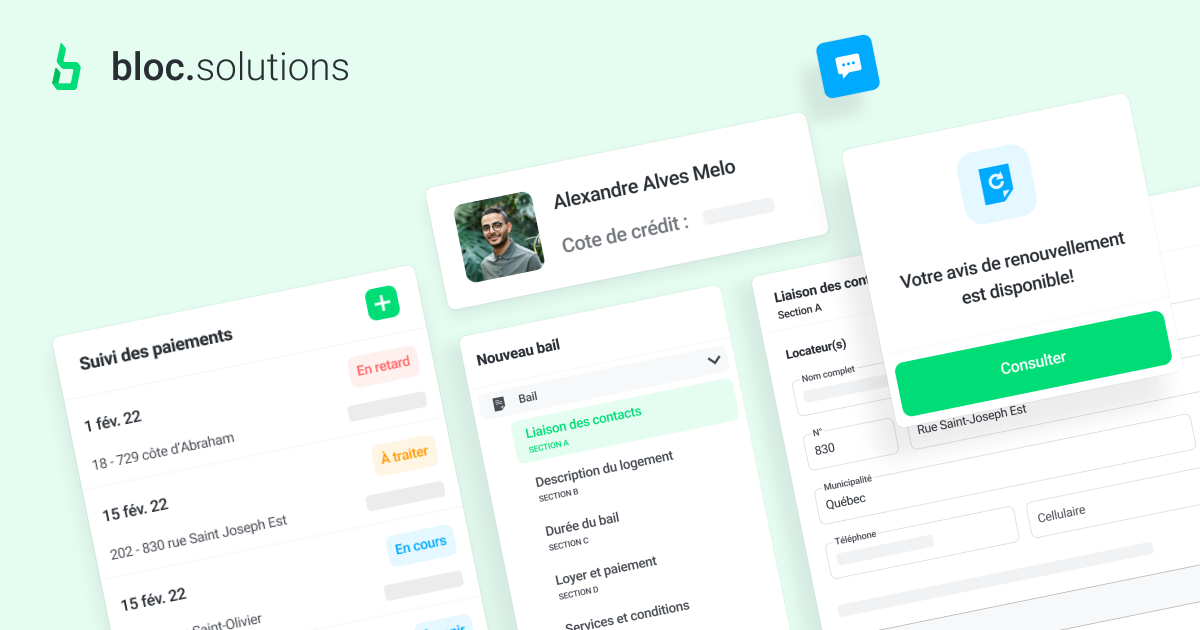

Do your pre-rental surveys faster with Bloc Solutions!

Did you know that you can conduct your pre-rental investigations on the Bloc Solutions platform?

In a few clicks, you obtain the consent of the candidate tenant and check his credit file, his rental and employment references, his file with the Tribunal administratif du logement, his criminal file, etc.

If the result is satisfactory, all you have to do is to convert the application into a rental lease. Nothing could be easier!

Click here to find out how Bloc Solutions can simplify your rental management now.