What is RL-31slip?

The RL-31 slip must be filed by all property owners who rented a unit with a rent paid or pble on December 31 of the year in question. It must be sent to all tenants and sub-tenants by the last day of February of the year following the reporting year. For example, the past year, the deadline for sending the RL-31 was February 28. Landlords who do not meet this deadline will be subject to a penalty from Revenu Québec.

There are two copies of the RL-31 slip, copy 1 (RL-31), that must be sent to Revenu Québec and copy 2 (RL-31.CS,) that must be sent to tenants and sub-tenants.

Is the RL-31 slip mandatory for all kinds of units?

The RL-31 slip must be filed for all dwellings that meet the following criteria:

- Located in Quebec.

- The rent was paid or payable on December 31 of the reporting year.

- It is not part of a low-income housing unit, as defined in the Civil Code of Quebec, including a dwelling located in a low-income housing unit (HLM) or for which the Société d’habitation du Québec agrees to pay an amount to ensure the payment of the rent.

- It is not considered to be a dwelling in low-rental housing by the Civil Code of Québec, such as a dwelling located in a low-rental housing (HLM) or for which the Société d’habitation du Québec pays an amount to have the rent paid.

- It is not part of a facility administered by a public or private institution operating a hospital, a CHSLD (Residential and Long-Term Care Centre) or a rehabilitation center governed by the Act respecting health services and social services.

- It is not a dwelling located in a hospital or a reception center under the Act respecting health services and social services for Cree Native persons.

- It is not a dwelling for which an amount of money is paid to pay the rent as stipulated by a program governed by the National Housing Act.

- It is not part of a housing community or premises where intermediate or family resources are provided.

- It does not qualify as a room in your principal residence if there are less than 3 rooms rented or offered for rent. However, there are exceptions: The room must have a separate exit or independent sanitary facilities.

- Finally, it is not a room in a hotel or in a rooming house rented or sublet for less than 60 consecutive days.

In general, the crucial thing to remember is that all landlords owning a residential rental building in which the tenants do not benefit from a subsidy, must file the RL-31 slip. For specific cases, it is necessary to refer to the criteria stated above and Revenu Québec.

What is the purpose of the RL-31 slip?

The occupancy information provided on this statement will allow tenants to claim the solidarity tax credit on their income tax returns.

Where to produce RL-31?

RL-31 can be filed :

- Starting December 1, directly in My account for indivituals or through the online service File and consult RL-31.

- Using software authorized by Revenu Québec.

- Using software that you have developed and that meets Revenu Québec requirements.

- On paper.

How to send RL-31 slip to Revenu Québec?

Copy 1 of RL-31 slip must be sent to Revenu Québec.

- If you file more than 50 RL-31 slips, it is mandatory that you send them by Internet.

- If you file less than 51 RL-31 slips, it is possible to send the files by Internet or by mail.

To send the files via Internet, they must be in XML format. Owners can use a software authorized by Revenu Québec, a software they developed themselves, provided it meets Revenu Québec’s requirements, or the online service File and consult RL-31. For more information on filing, visit the Revenu Québec website.

How to send RL-31 slip to tenants and sub-tenants?

It is important to send copy 2 of the RL-31 slip (RL-31.CS) to all tenants and sub-tenants listed on copy 1 of the RL-31 slip. Paper RL-31s must be sent in person or by mail. They may also be transmitted electronically. Electronic transmissions of statements must meet the following conditions:

- Have obtained the prior written consent of the tenant or sub-tenant, clearly indicating that they consent to the electronic transmission of the slip and that their permission remains valid until they notify you of their intention to revoke it.

- Inform the tenant or sub-tenant of the means they can use to revoke their consent.

- Protect the personal information of tenants and sub-tenants;

- Be able to verify the identity of any person giving consent.

- Ensure that the format of the RL-31 slips sent does not allow the alteration of the information contained therein.

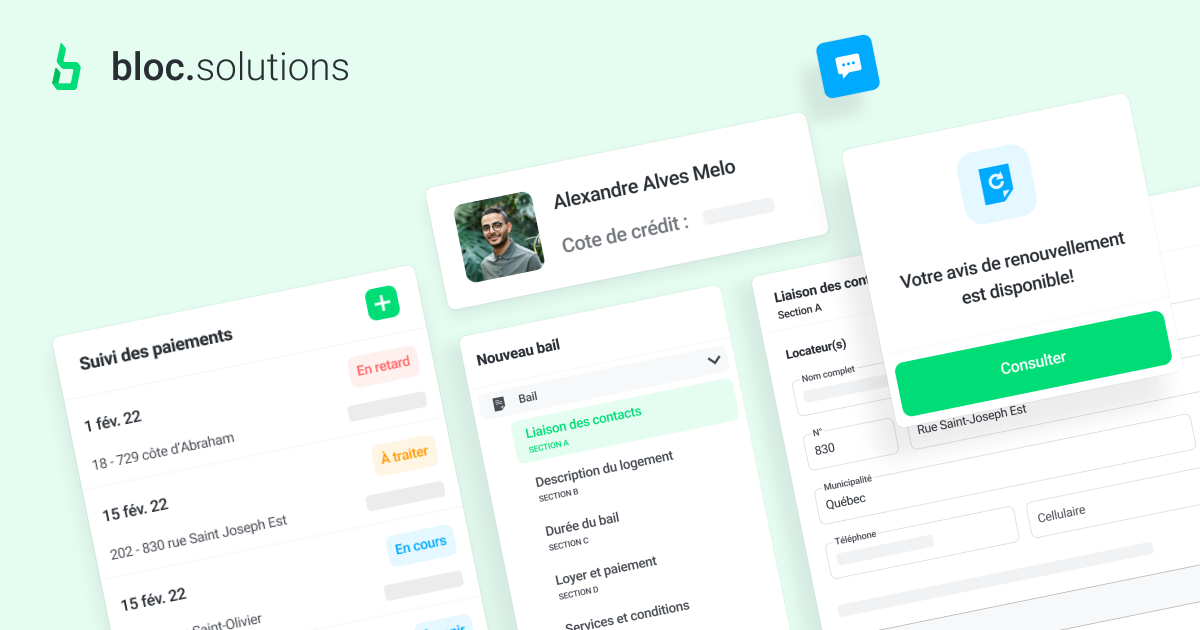

Did you know that it is possible to respect these conditions and send the RL-31 slip to your tenant(s) directly on the Bloc Solutions platform? Just import the document and choose the transmission method you prefer (email, SMS, or phone call) to notify the tenant. All Bloc Solutions users with a monthly subscription can transmit the RL-31 slip from the platform at no additional cost.

Consult our website to learn more and simplify your rental management now.

Sources : Revenu Québec